Amanda takes the host seat on this weeks 100 Proof and is joined by special guest Carly Reilly (Overpriced JPEGs), Sam (PROOF Director of Research), and Dalton (PROOF Research). They talk about the latest NFT topics including:

- Ordinals

- Pudgy Penguins & Nouns

- ApeFest moving to Hong Kong

- Is NFT Twitter leaving for Threads?

- A new episode of the Mythics Chronicles

- Sam chats with artist, trader and collector OSF

The discussion starts with a check-in on current market trends in the world of cryptocurrency and NFTs. With ETH and Bitcoin rallying lately there seems to be euphoria amongst investors but how does this impact the NFT market? Despite challenges, there are glimmers of hope that make this an exciting time for those willing to dig deep and find hidden gems within the industry.

Exploring Ordinals in Challenging Markets

Carly Reilly believes Bitcoin is as an excellent value store chain. She doesn’t see Bitcoin or Ordinals as the next PFP meta but more like great chains to store fine arts, especially with recent advancements like Recursion and projects such as Onchain Monkeys launching on Ordinals. Given how Bitcoin appears likely to come out unscathed amidst US regulations unlike other cryptocurrencies further bolsters its attractiveness!

Initially infrastructure necessary for an exploding NFT ecosystem was missing but now Magic Eden alongside big name influencers getting involved, we’re starting see those essential pieces fall into place – leading to increased optimism about what lies ahead despite stagnant market trends.

Pudgy Penguins Buying a Noun

Pudgy Penguins’ recent Noun purchase is a great example of projects supporting one another, using their resources and engaged followers to generate new interest. This latest move perfectly caters to NFT enthusiasts by collaborating with a highly respected name in NFTs – NounsDAO. Seeing such collaboration during tough times is exactly what we need more of in the community. Kudos to Luca!

BAYC ApeFest in Hong Kong

Yesterdays big news was Bored Apes announcing ApeFest in Hong Kong, targeting a new market interested in NFTs.

This move makes sense as Animoca is also based there. Many of the major NFT buyers seem to be located in Asia currently. By hosting an event in Hong Kong, Bored Ape Yacht Club acknowledges the resonance their product has found within these markets. Additionally, it capitalizes on Hong Kong’s crypto-friendly stance contrasted against the US’s less friendly approach towards cryptocurrencies.

Furthermore, luxury retail brands have always thrived exceptionally well within Central Hong Kong due mainly to its accessibility to China market consumers who appreciate status symbols — something which aligns perfectly with how NFTs have so far been utilized – predominantly as flexing tools or community membership tokens.

Mythics Chronicles Episode 7

The anticipation for the Mythic exhibition is building, and many are thrilled to see it live. Proof is hosting a Mythic celebration on July 21st at Foundry in Downtown Los Angeles where you can enjoy all that amazing art firsthand.

Yesterday Proof announced the start of the Toobins run – a fun activity designed as an antidote for bearish markets by engaging people and fostering excitement. It involves a worm NFT fork which should provide plenty of entertainment when transferred; and it morphs into a Toobins charm bound to your wallet!

Is NFT Twitter Going to Threads?

A few days ago Meta launched Threads, a potential rival to Twitter. Current data indicates that a few days later Threads’ daily users have dropped 20% and the time spent on the platform has decreased by 50%. Despite gaining 100 million users in five days, engagement with Threads remains low. Threads will not easily replace Twitter nor cause its demise overnight. Consumer behavior doesn’t change that rapidly. Many of us have invested significant time building our presence on these existing platforms making a switch unlikely at this point. The hosts also saw no chance of shifting to Threads, because their worlds of Instagram and Twitter are distinctively separate.

Artist Spotlight: OSF

OSF is an acclaimed artist and trader, mostly known for his works Red Light District and Rekt Guy on Twitter.

Prior to joining crypto, OSF was a bond trader at Barclays for ten years and has been interested in digital art since he was a teenager. In 2021, after taking a fifteen-year break from artistry, he began creating NFTs while also trading Bitcoin and Ethereum. His career started humbly by selling one piece followed by another, each earning slightly more.

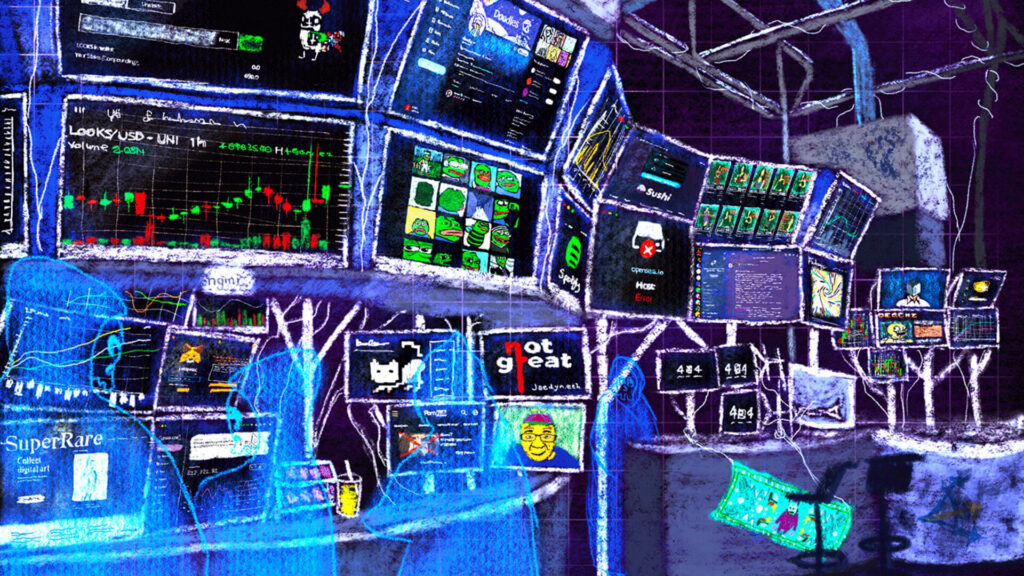

The turning point came with his work Professional Degen, which connected with people and got him accepted into Super Rare helping him transition from single-digit ETH sales to double digits. This piece’s success owed partly to its relatability capturing the current crypto zeitgeist along with his growing Twitter following giving potential investors confidence in his work.

Occasionally he creates lighter works such as Uperol Spritz (Summer 2022), where after months of negative-themed art reflecting market crashes, he aimed to offer something happy amidst all the negativity.

For his Red Light District project, he promised collectors a new drop every month until he passes away – which is pretty wild! It was released as an edition of 210 at 0.069 and surprisingly, they didn’t all sell out – so many were given away.

Having worked professionally in trading various assets classes before, what drew him into crypto are its volatility and upside potential compared with other markets where returns can range between 10% to max 70%. In contrast, crypto offers opportunities where returns can hit up to 1k percent!

Despite being aware that losing over half your investment overnight due to its volatile nature is highly possible; his years of disciplined training in finance have equipped him well in managing risks effectively while pursuing higher returns with greater confidence.

Trading successfully largely involves predicting shifts in public attention rather than focusing solely on cash flow. It’s mostly based on gut feelings coupled with some data analysis such as tracking number holders’ growth rates alongside social media mentions, etc.

His most famous trade involved selling off large quantities of Bored Apes during peak bull market season. Contrary to popular belief though, he wasn’t expecting the price to plummet soon after, nor did he foresee the upcoming crash NFTs. His main motive was simply to take advantage of the liquidity available at that moment in time.

His most famous creation Rekt Guy stands out because it’s not reliant on executing roadmaps or raising capital. Rekt Guy simply captures the evergreen concept of getting ‘wrecked’ in crypto culture, resonating with those who understand and appreciate the art and ideologies behind it.

On his Twitter, OSF has recently shown optimism about the state of crypto – due to macro factors indicating light at the end of tunnel:

- US inflation dropping substantially but still above Federal Reserve target shows economic strength.

- Labor market robustness indicates no recession.

- Potential rate cuts could happen next year.

- Big asset managers vying for Bitcoin ETFs signal high demand and success probability – leading others to follow suit

Even though Bitcoin has increased 85% this year, it remains down 50% from highs. If you’re still involved in crypto, chances are you believe in its tech, culture and ideas at least somewhat, This makes now an excellent time for risk-taking given these favorable conditions.

Here is the full episode and remember – follow them on Twitter @ProofPodcasts for all things related to Proof content!